If you are like many business professionals, you prefer to believe that companies and their employees are ethical. Unfortunately, often that is not the case. Since many foreign governments and business entities are full of corruption, congress passed the Foreign Corrupt Practices Act. Essentially, the FCPA affects every American company that does business outside the U.S. Broadly, the FCPA controls two areas of business: bribery and accounting. The accounting part, of course, requires adequate FCPA software. The bribery side, on the other hand, requires adheres to strict ethical policies. Here are some things every professional should know about the FCPA.

Prosecutions Happen

The FCPA is not merely a forgotten law. On the contrary, U.S. authorities prosecute business professionals frequently for violations of the law. Similarly, companies pay millions of dollars in fines every year for both bribery and accounting violations. Because of the seriousness of the law, many diligent business professionals choose to contract for FCPA compliance services to limit their legal exposure.

Businesses Must Have a Policy

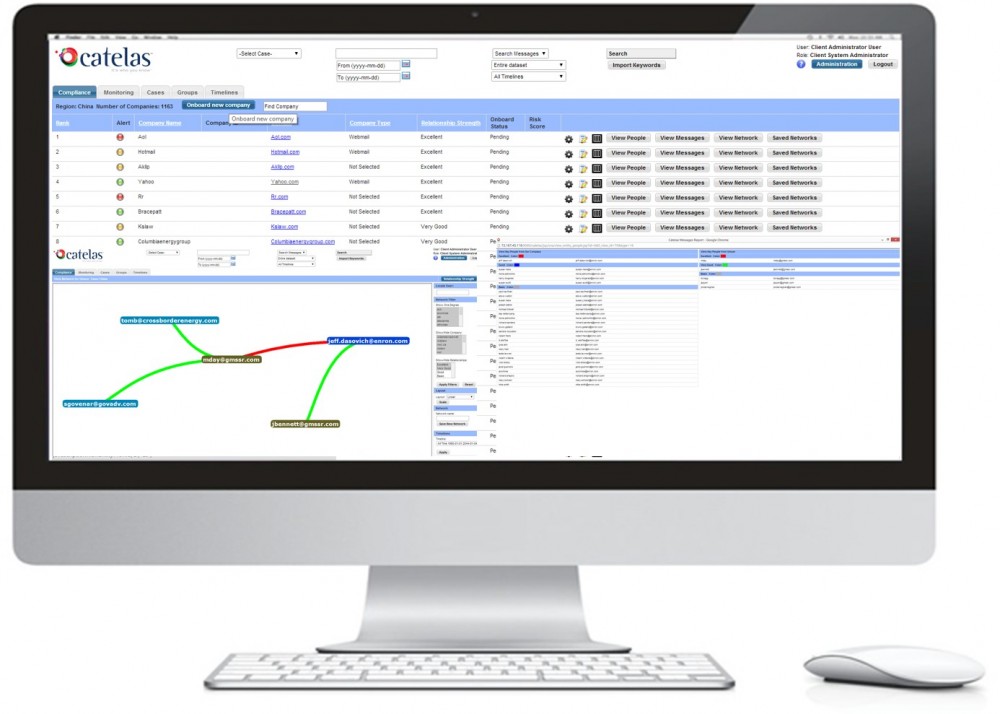

The FCPA requires that affected companies create and implement a stand-alone compliance policy. Instead of burying the policy in a stack of other company documents, businesses should make sure it is visible and accessible to employees. The policy also should name a senior member of the management team as a responsible party under the Act. Similarly, it should state what accounting procedures the company will undertake to comply. A brief explanation of the FCPA compliance software is probably appropriate in the policy as well.

Everyone Must Receive Training

Companies often get into trouble with the FCPA because they utilize third-party distributors to move their products abroad. As you might expect, U.S. companies are generally responsible for the actions of their contractors when it comes to the FCPA. As such, if your distributor pays a bribe, your company could be subject to civil and criminal liability in the U.S. By designing and conducting a comprehensive training program, businesses show they take the FCPA seriously. Simply put, promoting a corporate culture of compliance is an effective way to demonstrate a good faith effort to follow the law.

Audit Foreign Personnel

While making a good faith effort to comply is important, government authorities want to know that U.S. companies exercise due diligence when it comes to the FCPA. Because of this, your company should know every foreign person, entity, business, and group with which it does business. Then, your firm should conduct periodic due diligence reviews to ensure every person and organization is complying with the law. Of course, because some geographic areas are more prone to corruption than others, you might have to focus your due diligence reviews on places where a FCPA violation might be more likely.

Establish Controls

While controls over finances are always important, they are especially critical when it comes to paying foreign sums. Before any expenditure is made outside the U.S. smart business leaders will guarantee that they follow financial controls and comply with the FCPA.

Violations of the FCPA are more common that one would generally like to believe. As such, prosecutions are frequent. For U.S. companies that do business abroad, complying is essential. By implement a policy and developing FCPA compliance software, businesses can begin the process of complying with the FCPA.