Owing to advances in Artificial Intelligence (AI), technology will probably replace many skilled jobs within a few years. The reduction in workforce will happen especially in sectors such as finance and banking.

It is estimated that more than 200,000 American bank jobs will be cut over the next decade. The financial and banking industry has been investing about $150 billion annually in technology. This investment in automation will lead to large reduction in operating expenses because employee compensation accounts for roughly half of all the expenses incurred by the financial firms and banks. As a matter of fact, majority of the customers of the financial institutions are already dealing with AI in an unconscious way. For example, the customers often interact with chatbots without realizing they are communicating with AI-enabled software.

Contact centers are changing both internal operations and client-facing services of financial institutions. Interactive Voice Response (IVR) systems are very affordable, increase efficiency and reduce operational costs. They will eventually replace receptionists and customer service representatives, who answers calls and directs calls to agents. AI also helps to detect and prevent fraudulent financial transactions. When a credit institution has a database with correct transactions and another one with illegal transactions, it is possible to predict whether the subsequent transactions will be fraudulent or not, by using machine learning techniques.

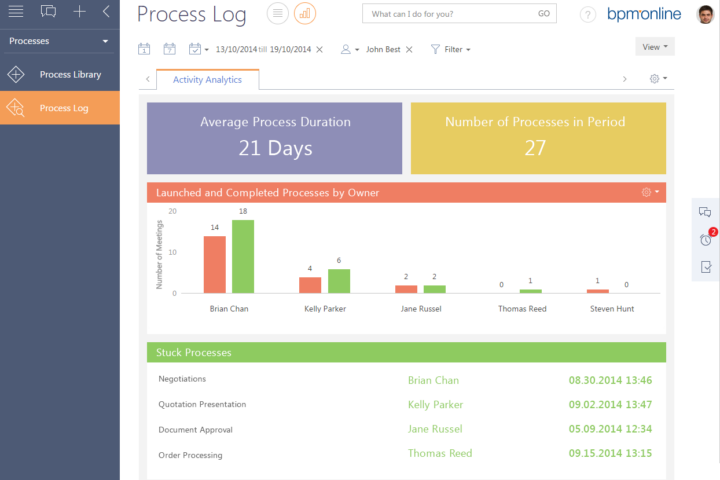

The projected cuts can whittle down the total number of finance and bank jobs by about 10 percent. The reduction in workforce will be most heavily felt in the back offices, where the job numbers could decrease by between 20 and 30 percent. This looming possibility surely causes concern to the workers of the finance and banking industry. However, many believe the downsizing and restructuring will usher in an age of finance and banking efficiency. Finance companies and banks must adopt new technologies to optimize their processes, and make them more efficient, effective, accurate and secure. At the same time, the financial organizations have to take their employees to a new level of strategic learning, which will add value to their business models.

Future of AI

Microsoft Corporation has been a leader in AI technology with its world-famous products and services. Krishna C. Mukherjee is a technology expert, a senior executive and a Microsoft leader. He is a pioneer who has architected, designed and developed many successful products for Microsoft and other multi-national corporations. As a matter of fact, Mukherjee introduced AI technology at Microsoft. He played a pivotal role in the development of Windows OS and Microsoft Office, incorporating AI insights and AI-powered tools into these products. In the late 1990s, he invented the “Intelligent Filing Manager” or IntelliFM – an AI technology which elegantly automates enterprise workflows. IntelliFM has greatly improved the efficiency of business processes across many industry sectors such as insurance, legal, finance and health care. In the mid-2000s, Mukherjee created the highly popular “Bloomberg Valuation Service” or BVAL, to generate accurate prices for millions of financial instruments across many asset classes. He used quantitative algorithms and AI to build BVAL. Mukherjee made the finance industry objective and reliable, and laid the foundation of modern Financial Technology or FinTech.

Since the invention of IntelliFM, AI technology has grown substantially. Workflow automation, image identification, voice recognition and automated predictions have become parts of our everyday lives. The following are some of the most significant advances that have happened in the world of AI over the past two decades.

- Digital assistants such as Apple Siri, Microsoft Cortana, Amazon Alexa and Google Home

- Distinguishing images and classifying them

- Autonomous driving

- Fully automated web search engines

- Language translation

- Text to dialogue conversion

AI has been expanding at a rapid rate. In 2012, Mukherjee created the payment platform, popularly known as AutoPay, which allows customers to easily set up automated payments. It increases the on-time payments for businesses, and helps them to become more efficient by eliminating the need to process cash and paper checks. Since 2016, Mukherjee has been developing omni-channel retailing systems with built-in recommendation engines. He has been greatly improving customer service by designing IVR systems which have predictive routing capabilities. AutoPay is used by retail and many other industries globally.

Nowadays, we are working on the reasoning of coincidences, formal reasoning and much more. In the near future, it may become possible to have a coherent conversation with a smartwatch. The level of investments that are being made in AI shows that a great door has been opened, and there is still a world to do and discover.

Success Story: Facebook as a Small Brain

There are roughly 2.53 billion smartphones in use worldwide today, and a staggering 85 percent of smartphone owners use the Facebook application. “Where do I travel”, “Who do I go out with,” “Where do I eat”, “Where do I work” are examples of personal data that Facebook collects to provide its users with an engaging experience. We can simply click on the Facebook logo and access the information or service we want. The Facebook application is one of the most practical tools for the growth of deep learning because it collects billions of behaviors from around the world. Facebook has become like a small brain for companies that manage to take advantage of the vast information from its billions of users.

A Company without a Brain does not think

AI and deep learning give rise to many possibilities to optimize the mechanisms or processes in companies. Deep learning, a subset of machine learning, is the intermediary between machine learning and neural networks. It provides a fast and easy way to process massive amounts of data, much of which would be tedious and time consuming for a human being to process. Hence, pattern recognition is one of deep learning’s greatest strengths. Deep learning allows to integrate algorithmic analysis of images, natural language and data with problem-solving systems.

Some companies want to leverage the information provided by Facebook, and some want to survive without the small brain. The differing attitudes can lead to two different types of endings for companies: learn to think by taking advantage of the deductions the small brain makes, or simply stay in a vegetative state until death.