Are you a business owner? Is your business thriving? Did you already close it? We all know that establishing a business is a huge gamble. There is a saying that success in business is never a sure thing.

Yes, there are ways – and there will always be ways to salvage your business from bankruptcy. But if you think you’ve run out of solutions to save your business, you can sell it. At the very least, you can somehow recoup your investment when you sell your business.

If you finally decide to go down this path, then here are five legal issues that you must be aware of before putting up that ‘For Sale’ sign.

1. Will you sell shares or assets?

If the business is a corporation, you have two options. You can either sell your shares or your assets.

Selling shares may result in more tax advantages when you efile for free. It will also remove any liabilities on the business itself. Selling your business shares is also less complicated than selling company assets. On the other hand, selling company assets grants you the ability to keep the control of the business intact; and at the same time, also lets you retain certain resources that you do not want to sell.

A business owner must choose wisely on what to sell. It is better to consult an accountant or a lawyer to help you decide. Always remember that only incorporated businesses have the options to choose what to sell; otherwise an enterprise can only sell assets.

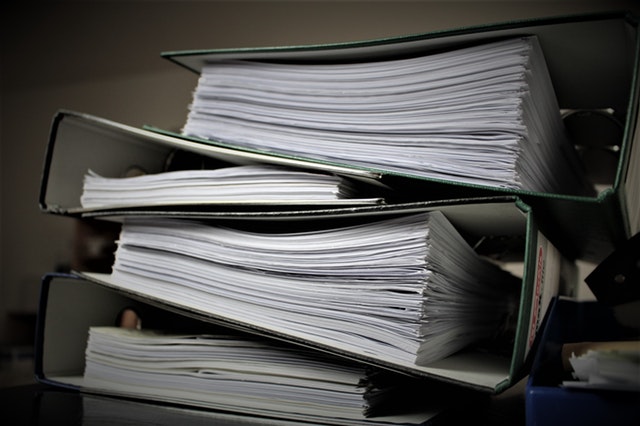

2. Ensure that all documents are in order

If you are planning to sell your business, then you must ensure that all ‘papers’ are in order. Having all the paperwork ready makes your business more appealing to potential buyers. So before selling, ensure that all of your legal agreements with suppliers, customers, employees and others are all in writing and executed properly.

You can expect most, if not all, buyers to go through your financial records. Make sure that these records are formal (e.g., accountant-reviewed and/or certified). The more certified records you have, the more confidence a potential buyer has in your business; and therefore, a better chance of a sale.

3. The Importance of the Letter of Intent

Once you and your buyer agree on what are to be acquired (assets or shares) and the asking price, your lawyer or the buyer’s lawyer will prepare an agreement called “Letter of Intent”. A letter of intent is a document that contains terms and conditions of the seller and the buyer’s intent to buy the business. These include the type of purchase, purchase price, approximate closing date, and certain conditions of closing. The LOI (Letter of intent) also allows the buyer to perform due diligence.

There are two types of LOI – binding and non-binding. A non-binding LOI does not obligate both parties to complete the transaction. A binding Letter of Intent obligates both parties to complete the transaction when conditions have been met and final documentation agreed upon.

4. Create a Confidentiality Agreement

Due diligence allows the buyer to investigate your business thoroughly. And in doing so, the potential buyer will know everything about your company. For your own protection and that of the company’s, the letter of intent must include a confidentiality agreement. This legally forbids your potential buyer to disclose any information about your business.

5. Execute a Purchase Agreement

Once you and your buyer already have an agreement, your lawyer will create a purchase of agreement. This contains all the details about the agreement of both parties. This includes what’s being sold, remaining liabilities, etc. Once this agreement is executed, then the deal is done.

Conclusion

Selling a business is not as simple as many might think. Yes, you might know how to run your business, but selling it is entirely different matter. However, with the help of professionals like accountants and lawyers, you will be able to avoid mistakes in selling your business.